First let's look a little in general at how markets interact, then we'll examine in more detail.

Market Relationships (during typical inflation)

- Stocks and bonds usually trend together.

- Bonds usually change direction before stocks.

- Stocks and commodities usually trend together.

- Commodities usually change direction after stocks.

- The U.S. dollar trends in the opposite direction of commodities and inflation.

- Inflation moves up as stocks get higher.

- Interest rates rise to fight inflation, causing bonds to turn down, then stocks, then commodities.

During periods of economic health, stocks and bonds should both trend up, because this shows full confidence in the business environment. Commodities should trend slightly up, showing increased demand, but not overly inflationary demand. Inflation should by the same token be slight. However, vigorous growth in the economy will also cause dollar to rise, pushing inflation and the cost of commodities down. This reflects a time of great expansion and prosperity.

Prosperity that is driven too much by monetary expansion and not enough by real growth causes inflation. Inflation causes interest rates to rise, which eventually signals an end to the expansion.

Prosperity that is driven too much by monetary expansion and not enough by real growth causes inflation. Inflation causes interest rates to rise, which eventually signals an end to the expansion.

In deflationary economies, which are rare but not unheard of, stocks and bonds decouple and begin to move in opposite directions. Stocks down and bonds up. This is because a deflationary environment is much more uncertain. Money becomes more scarce and begins to seek out the safest haven, that being bonds. This is known as the "flight to safety" or "risk-off."

We have seen this come and go in the last fifteen years because of deflationary pressures on the world's economies. Stocks and bonds moving markedly differently are a clue the economy has an underlying deflationary problem--as they have been lately with bonds being very strong and stocks being so-so. Central banks have been pumping massive amounts of money into economies to stave off deflation. So far they've been fairly successful. But because of the huge amounts of world-wide debt, deflationary pressures are still there and aren't going away soon.

A Full Business Cycle

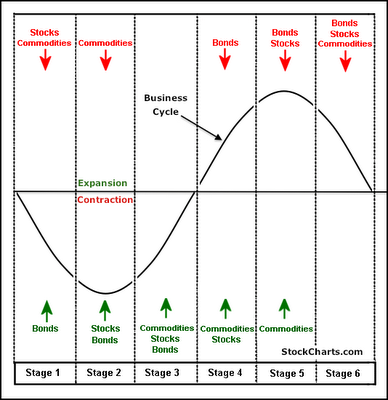

Below is a diagram showing a full business cycle from late contraction (recession), through early and late expansion (recovery), to early contraction. Let's go through this from left to right. (Note that in this example rising inflation implies a falling dollar, and vice versa.)

A Full Business Cycle

Below is a diagram showing a full business cycle from late contraction (recession), through early and late expansion (recovery), to early contraction. Let's go through this from left to right. (Note that in this example rising inflation implies a falling dollar, and vice versa.)

- Stage 1: In the late stages of an economic contraction or recession, stocks, bonds and commodities have been falling. The economy has slowed markedly. Finally, interest rates fall to attract borrowing, causing bonds to rise.

- Stage 2: Commodities continue to fall, but interest rates begin to drive down inflation. Stocks begin to rise with bonds in anticipation of a recovery.

- Stage 3: Inflation is down. Due to expansion, however, commodities begin to rise with stocks and bonds. Who cares? The recovery is on! Happy days are here again! Buy! Buy!

- Stage 4: Rising commodities and other prices mean rising inflation. Interest rates rise to control inflation, causing bonds to fall.

- Stage 5: Rising interest rates signal to investors that the party is nearing an end. They begin to dump stocks, pushing the stock market down. Commodities continue to rise however, because inflation is not under control yet.

- Stage 6: High interests rates have slowed inflation. But the evacuation is full tilt. Commodities, stocks and bonds all fall together. Investors run for cover! The world is coming to an end! Sell! Sell!

Until.... back to Stage 1.

Understanding how markets interact is a great help in understanding what in the world is going on in the world's economies. I'll refer to these principles again and again in later posts.

This comment has been removed by the author.

ReplyDelete